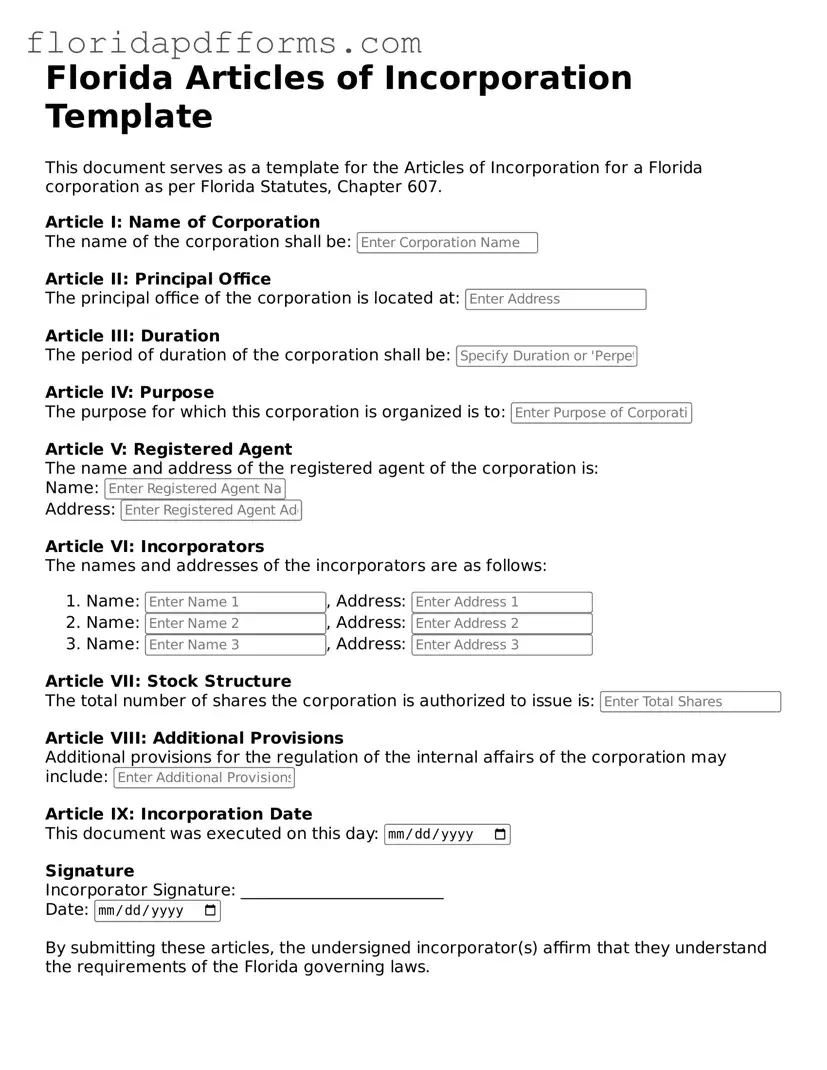

Official Articles of Incorporation Template for Florida

The Florida Articles of Incorporation form is a legal document required to establish a corporation in the state of Florida. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing this form is a crucial step for anyone looking to start a business in Florida.

Ready to take the next step? Fill out the form by clicking the button below.

Modify Articles of Incorporation Now

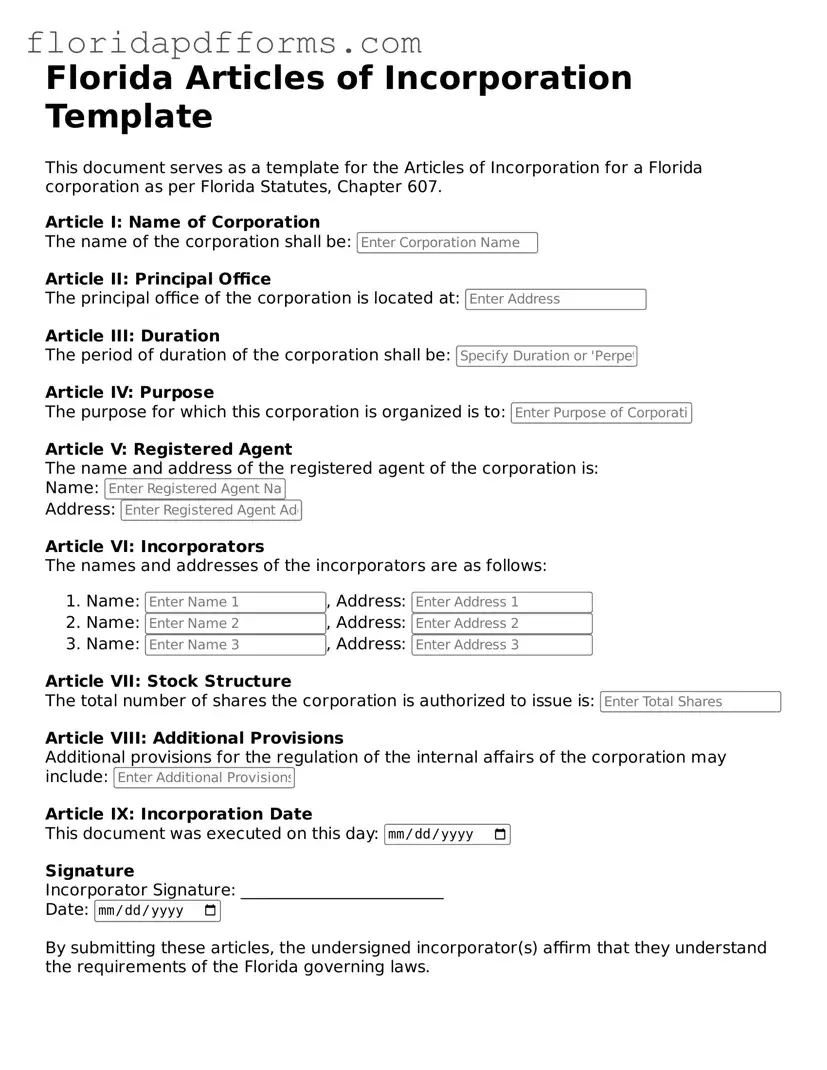

Official Articles of Incorporation Template for Florida

Modify Articles of Incorporation Now

Modify Articles of Incorporation Now

or

⇓ Articles of Incorporation File

Don’t stop halfway through your form

Finish your Articles of Incorporation online with quick edits and instant download.