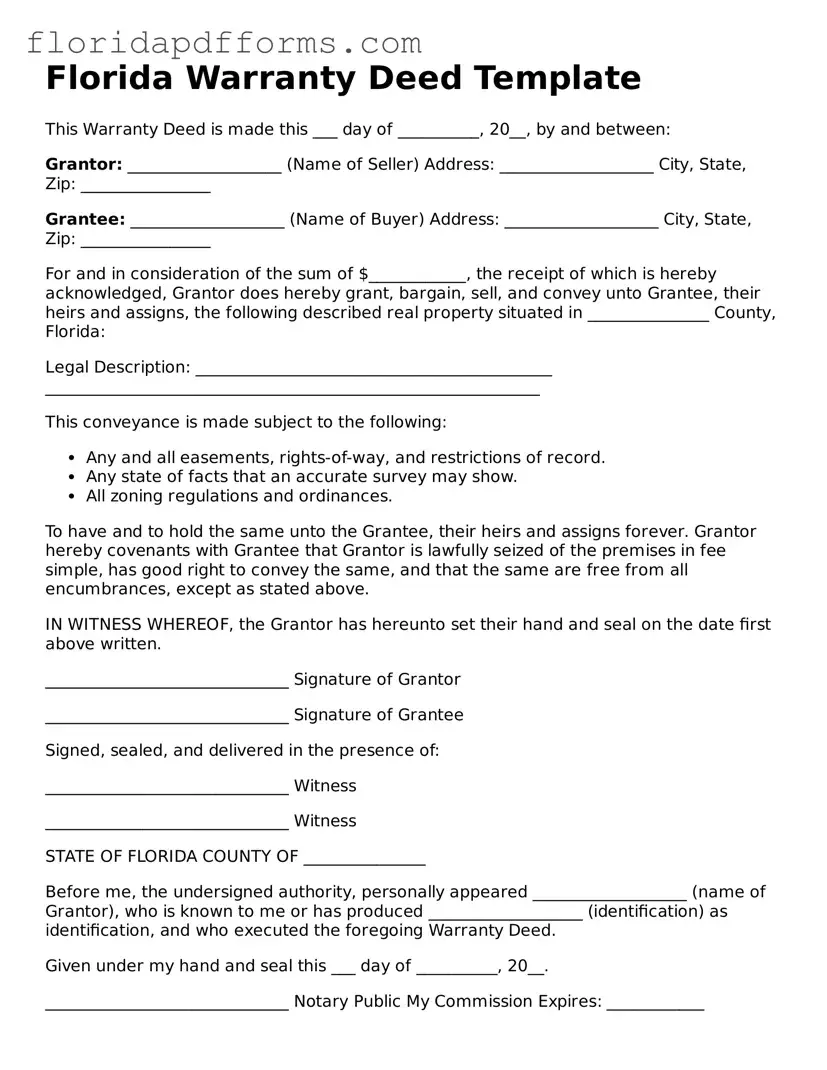

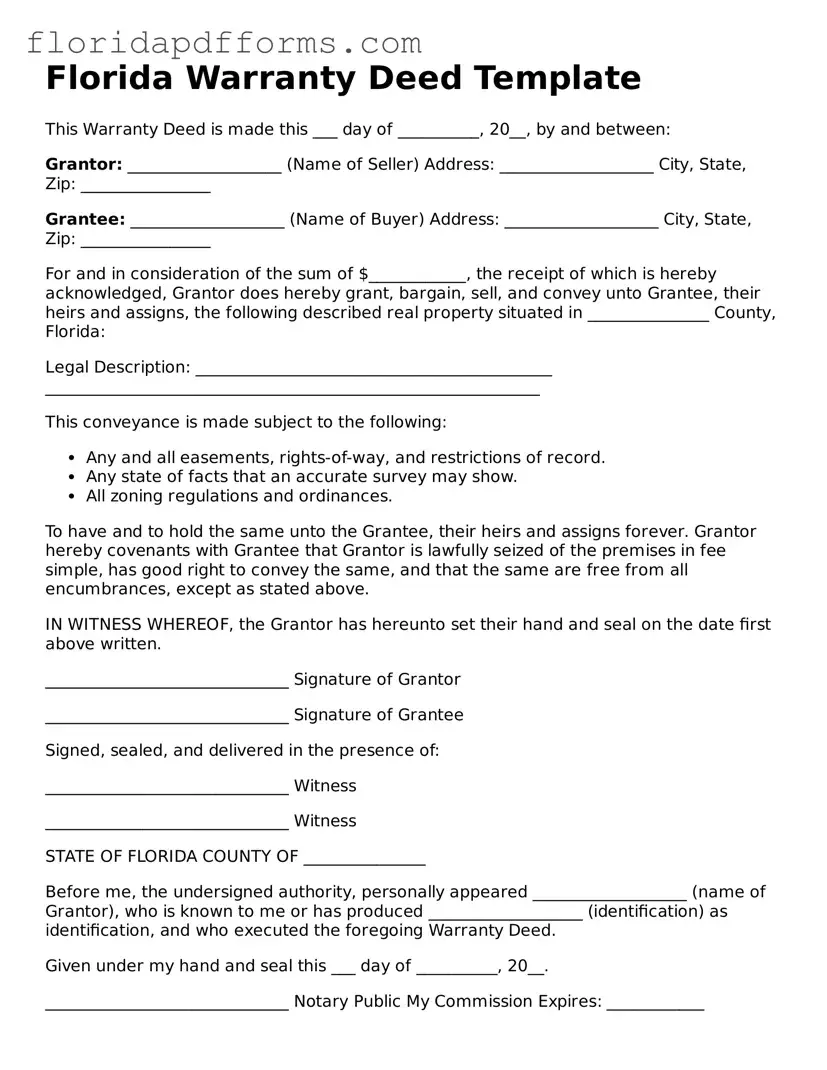

Official Deed Template for Florida

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines the details of the transaction, including the names of the parties involved and a description of the property being transferred. For those looking to complete a property transfer in Florida, filling out this form is an essential step; click the button below to get started.

Modify Deed Now

Official Deed Template for Florida

Modify Deed Now

Modify Deed Now

or

⇓ Deed File

Don’t stop halfway through your form

Finish your Deed online with quick edits and instant download.