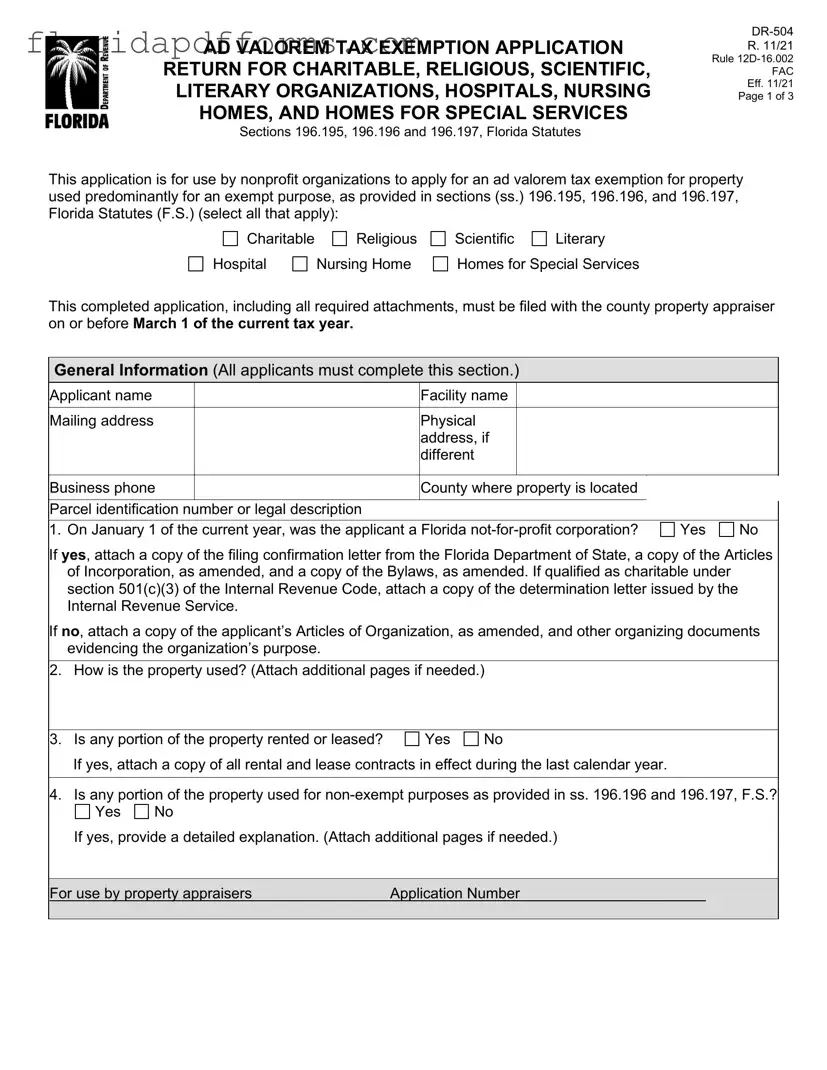

AD VALOREM TAX EXEMPTION APPLICATION

AND RETURN FOR CHARITABLE, RELIGIOUS, SCIENTIFIC, LITERARY ORGANIZATIONS, HOSPITALS, NURSING

HOMES, AND HOMES FOR SPECIAL SERVICES

DR-504

R. 11/21

Rule 12D-16.002

FAC

Eff. 11/21

Page 1 of 3

Sections 196.195, 196.196 and 196.197, Florida Statutes

This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an exempt purpose, as provided in sections (ss.) 196.195, 196.196, and 196.197, Florida Statutes (F.S.) (select all that apply):

Charitable

Religious

Religious

Scientific

Literary

Literary

Homes for Special Services

This completed application, including all required attachments, must be filed with the county property appraiser on or before March 1 of the current tax year.

General Information (All applicants must complete this section.)

Applicant name |

|

Facility name |

|

|

|

|

|

|

|

|

|

Mailing address |

|

Physical |

|

|

|

|

|

address, if |

|

|

|

|

|

different |

|

|

|

|

|

|

|

|

|

Business phone |

|

County where property is located |

|

|

|

|

|

|

|

|

Parcel identification number or legal description |

|

|

|

|

|

|

|

|

|

|

|

1. On January 1 of the current year, was the applicant a Florida not-for-profit corporation? |

Yes |

No |

If yes, attach a copy of the filing confirmation letter from the Florida Department of State, a copy of the Articles of Incorporation, as amended, and a copy of the Bylaws, as amended. If qualified as charitable under section 501(c)(3) of the Internal Revenue Code, attach a copy of the determination letter issued by the Internal Revenue Service.

If no, attach a copy of the applicant’s Articles of Organization, as amended, and other organizing documents evidencing the organization’s purpose.

2. How is the property used? (Attach additional pages if needed.)

3. Is any portion of the property rented or leased?

If yes, attach a copy of all rental and lease contracts in effect during the last calendar year.

4.Is any portion of the property used for non-exempt purposes as provided in ss. 196.196 and 196.197, F.S.?

Yes

Yes

No

No

If yes, provide a detailed explanation. (Attach additional pages if needed.)

For use by property appraisers |

Application Number ______________________ |

|

|

|

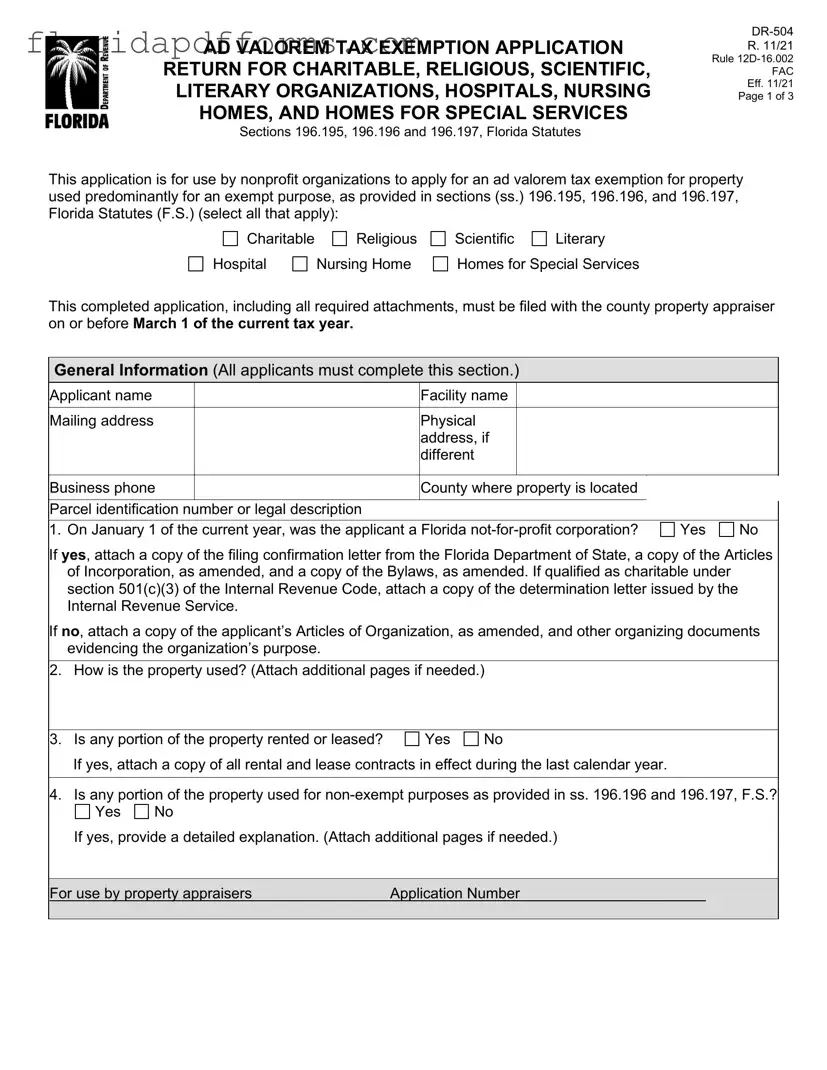

DR-504

Eff. 11/21

Page 2 of 3

Hospitals, Nursing Homes, and Homes for Special Services

1. On January 1 of the current year, was the applicant qualified as charitable under section 501(c)(3) of the

Internal Revenue Code, as determined by the Internal Revenue Service?

Yes

Yes

No

No

If yes, attach a copy of the determination letter from the Internal Revenue Service, a copy of the Articles of Incorporation, as amended, and a copy of the Bylaws, as amended.

2.On January 1 of the current year, did the organization hold a valid license issued by the Agency for Health Care Administration under

Chapter 395, F.S. – Hospital or Ambulatory Surgical Center |

Yes |

No |

Chapter 400, F.S. – Nursing Home, Home for Special Services and Related

Health Care Facility, or |

Yes |

No |

Part I, Chapter 429, F.S. – Assisted Living Facility? |

Yes |

No |

If yes, attach a copy of the license issued by the Agency for Health Care Administration.

Attachments (All applicants must attach the following information to this application.) On each attachment, include your name, address, and an indication that the information is an attachment to this application.

1.Provide a copy of the organization’s most recent financial statement.

2.Provide a copy of the organization’s most recent federal tax return (if filed).

3.Provide the following fiscal and other records showing in reasonable detail the financial condition, record of operation, and exempt and nonexempt uses of the property, where appropriate, for the immediately preceding fiscal year:

a.A schedule of payments or advances, directly or indirectly, by way of salaries, fees, loans, gifts, bonuses, gratuities, drawing accounts, commissions or other compensation (except reimbursements for reasonable out-of-pocket expenses incurred on behalf of the applicant) to

•any officer, director, trustee, member, or stockholder, or

•any person, company, or other entity directly or indirectly controlled by the applicant.

b.An explanation for the guarantee of any loan to or obligation of any officer, director, trustee, member, or stockholder of the applicant or any entity directly or indirectly controlled by the applicant.

c.Any contractual arrangement by the applicant or any officer, director, trustee, member, or stockholder of the applicant regarding the

•rendition of services;

•provision of goods or supplies;

•management of the applicant;

•construction or renovation of the property;

•procurement of the real, personal, or intangible property; and

•other similar financial interest in the affairs of the applicant.

d.A schedule of payments or amounts for

•salaries for operation;

•services received;

•supplies and materials;

•reserves for repair, replacement, and depreciation of the property;

•any mortgage, lien, and other encumbrances; and

•other purposes (explain).

e.A schedule of charges for services rendered by the applicant. If the charges for services rendered exceed the value of the services rendered, information on whether the excess is used to pay maintenance and operational expenses furthering its exempt purpose or to provide services to persons unable to pay for the services.

f.An affirmative statement that no part of the property, or no part of the proceeds of the sale, lease, or other disposition of the property, will inure to the benefit of its members, directors, or officers, or to any person or firm operating for a profit or for a nonexempt purpose.

DR-504

Eff. 11/21

Page 3 of 3

Signature (ALL applicants must complete this section.)

Florida law requires property appraisers to determine whether an organization uses the identified property for exempt purposes before granting an ad valorem tax exemption. Property appraisers will notify you if additional information or documentation is needed to determine eligibility for the exemption requested.

I certify all information on this application, including any attachments, is true, correct, and in effect on January 1 of the tax year.

Need Help? |

|

In Florida, local governments are responsible for administering property tax. The best |

|

|

resource for assistance is the property appraiser in the county where the property is |

|

|

located. Find websites for county property appraisers at: |

FloridaRevenue.com/Property/Pages/LocalOfficials.aspx

Religious

Religious

Literary

Literary

Yes

Yes

No

No

Yes

Yes

No

No