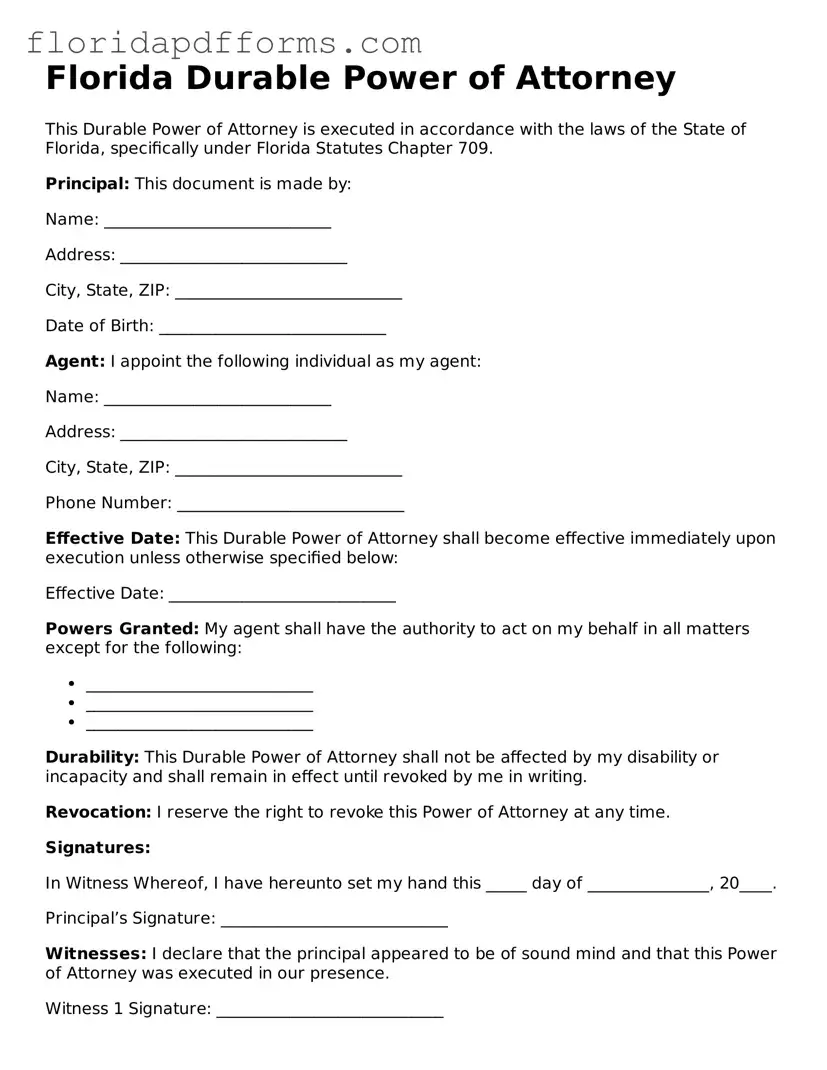

Official Durable Power of Attorney Template for Florida

A Florida Durable Power of Attorney form is a legal document that allows an individual to designate another person to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. Understanding the importance of this document is crucial for anyone looking to secure their financial future.

To take action, fill out the Florida Durable Power of Attorney form by clicking the button below.

Modify Durable Power of Attorney Now

Official Durable Power of Attorney Template for Florida

Modify Durable Power of Attorney Now

Modify Durable Power of Attorney Now

or

⇓ Durable Power of Attorney File

Don’t stop halfway through your form

Finish your Durable Power of Attorney online with quick edits and instant download.