Fill in Your Florida Dr 157 Form

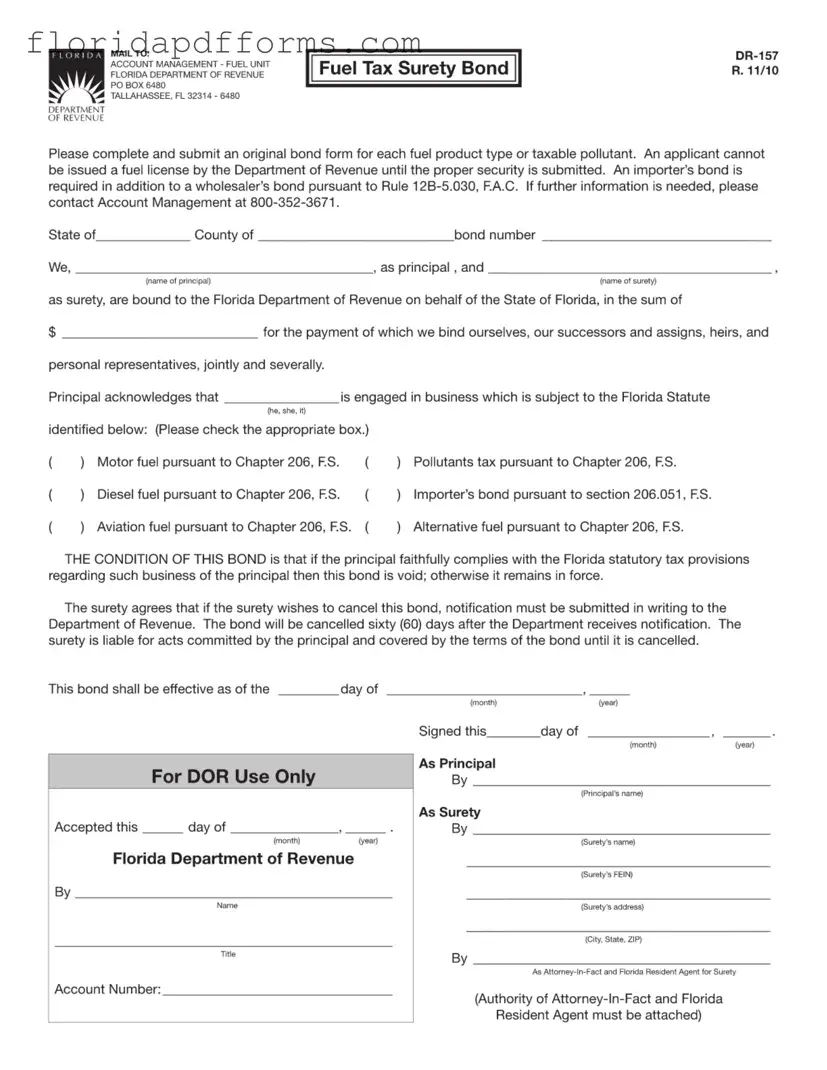

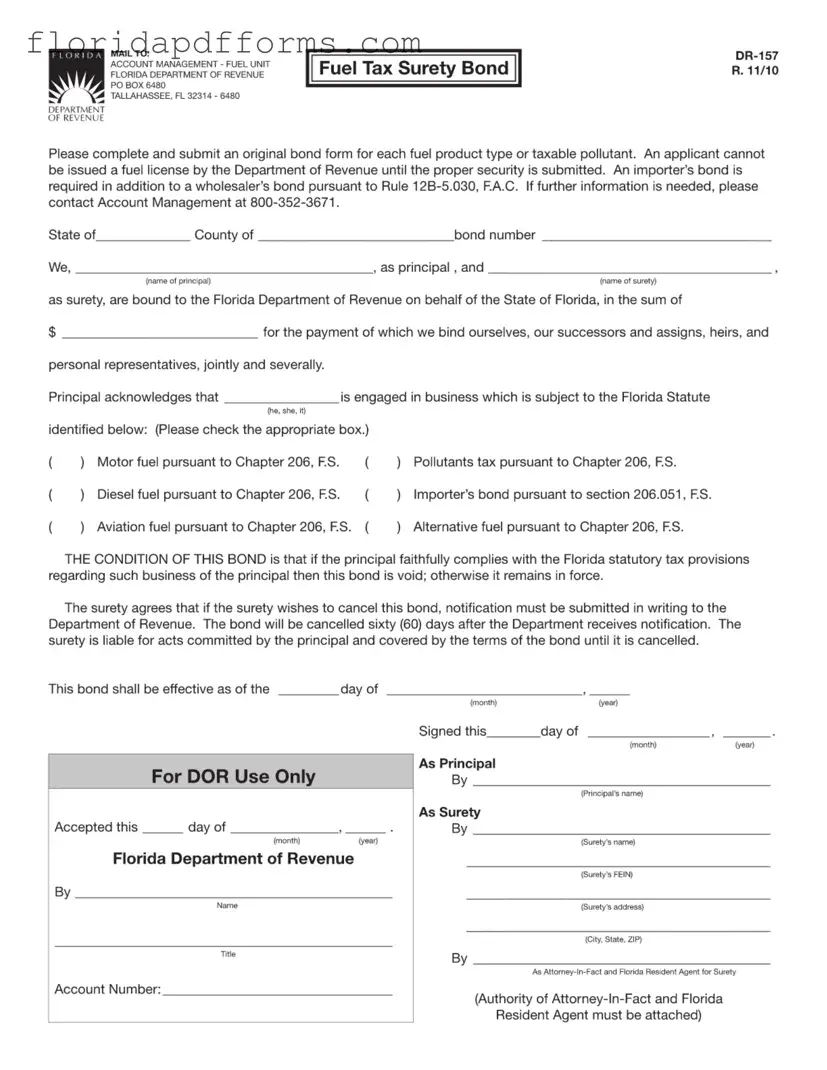

The Florida DR 157 form is a crucial document known as the Fuel Tax Surety Bond. This form must be completed and submitted for each type of fuel product or taxable pollutant to ensure compliance with state regulations. It is important to understand that without this bond, an applicant cannot receive a fuel license from the Florida Department of Revenue.

If you need to fill out the Florida DR 157 form, please click the button below.

Modify Florida Dr 157 Now

Fill in Your Florida Dr 157 Form

Modify Florida Dr 157 Now

Modify Florida Dr 157 Now

or

⇓ Florida Dr 157 File

Don’t stop halfway through your form

Finish your Florida Dr 157 online with quick edits and instant download.