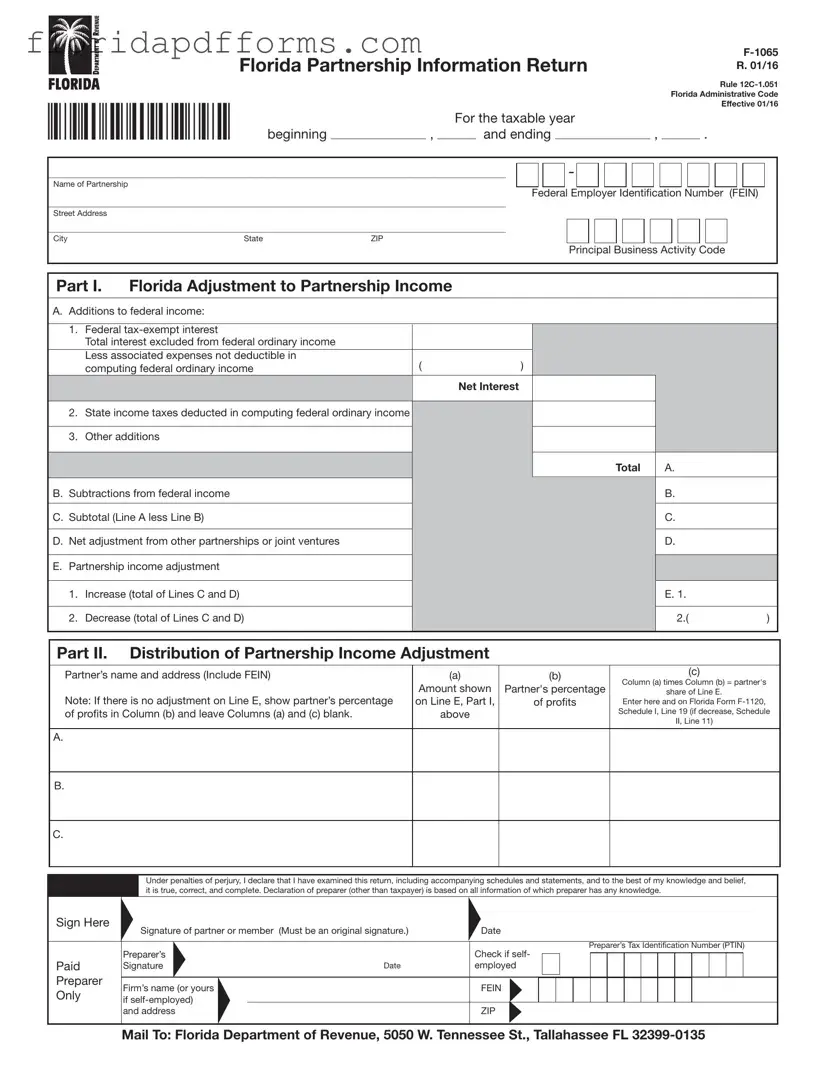

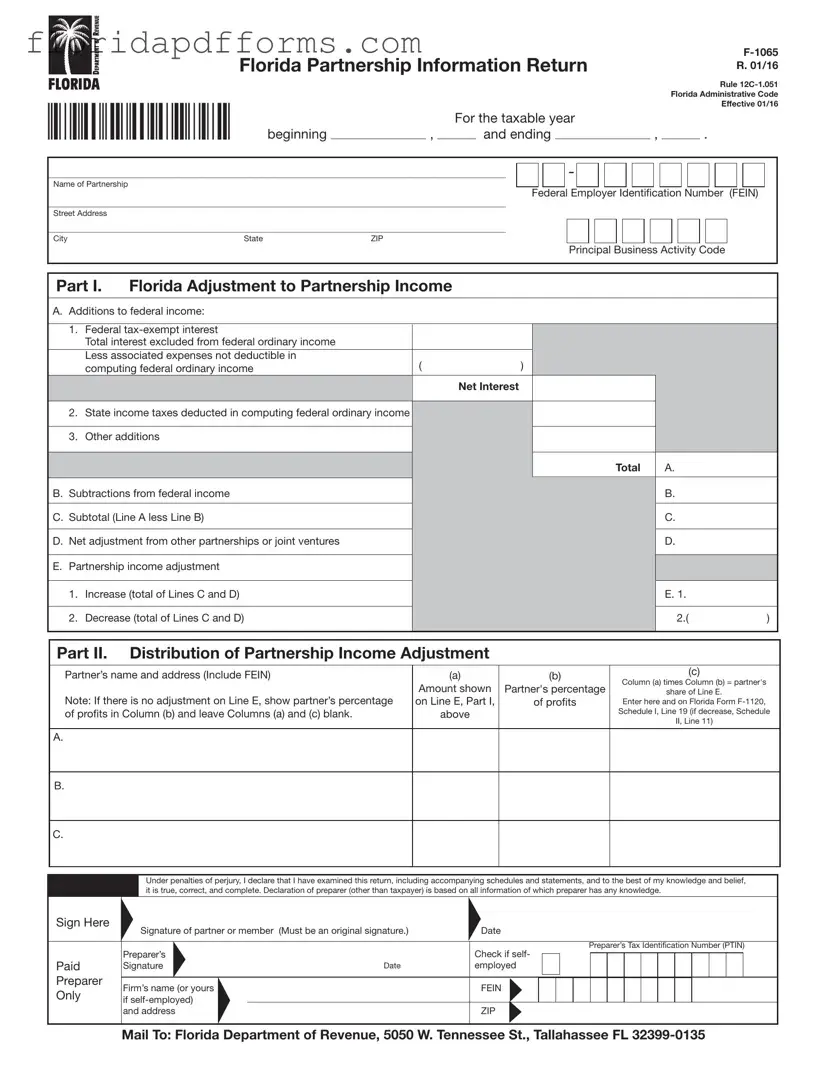

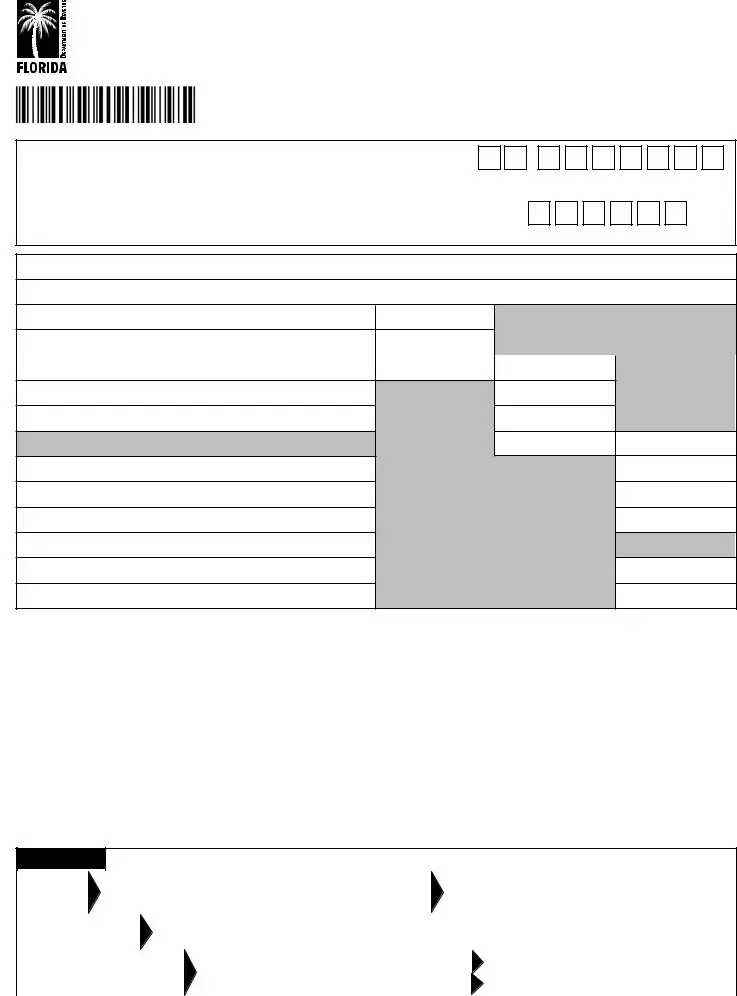

General Instructions

Who Must File Florida Form F-1065?

Every Florida partnership having any partner subject to

the Florida Corporate Income Tax Code must file Florida

Form F-1065. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes, must also file Florida Form F-1065. A Florida

partnership is a partnership doing business, earning income, or existing in Florida.

Note: A foreign (out-of-state) corporation that is a partner in a Florida partnership or a member of a

Florida joint venture is subject to the Florida Income Tax Code and must file a Florida Corporate Income/

Franchise Tax Return (Florida Form F-1120).

A corporate taxpayer filing Florida Form F-1120 may use Florida Form F-1065 to report the distributive share of its partnership income and apportionment factors from a partnership or joint venture that is not a Florida partnership.

Where to File

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0135

When to File

You must file Florida Form F-1065 on or before the first

day of the fourth month following the close of your taxable year.

If the due date falls on a Saturday, Sunday, or federal or state holiday, the return is considered to be filed on time if

postmarked on the next business day.

Extension of Time to File

To apply for an extension of time for filing Florida Form

F-1065, you must complete Florida Form F-7004, Florida Tentative Income/Franchise Tax Return and Application for Extension of Time to File Return.

You must file Florida Form F-7004 to extend your time to file. A copy of your federal extension alone will not extend the time for filing your Florida return. See Rule 12C-1.0222, Florida Administrative Code (F.A.C.), for

information on the requirements that must be met for your request for an extension of time to be valid.

Extensions are valid for six months. You are only

allowed one extension.

Attachments and Statements

You may use attachments if the lines on Florida Form

F-1065 or on any schedules are not sufficient. They must

contain all the required information and follow the format of the schedules of the return. Do not attach a copy of the federal return.

Signature and Verification

An officer or person authorized to sign for the entity must

sign all returns. An original signature is required. We will not accept a photocopy, facsimile, or stamp. A receiver,

trustee, or assignee must sign any return required to be filed for any organization.

Any person, firm, or corporation who prepares a return for

compensation must also sign the return and provide:

•Federal employer identification number (FEIN).

•Preparer tax identification number (PTIN).

Rounding Off to Whole-Dollar Amounts

Whole-dollar amounts may be entered on the return and

accompanying schedules. To round off dollar amounts,

drop amounts less than 50 cents to the next lowest dollar

and increase amounts from 50 cents to 99 cents to the

next highest dollar. If you use this method on the federal return, you must use it on the Florida return.

Taxable Year and Accounting Methods

The taxable year and method of accounting must be the same for Florida income tax as it is for federal income tax. If you change your taxable year or your method of accounting for federal income tax, you must also change the taxable year or method of accounting for Florida income tax.

Final Returns

If the partnership ceases to exist, write “FINAL RETURN”

at the top of the form.

General Information Questions

Enter the FEIN. If you do not have an FEIN, obtain one from the Internal Revenue Service (IRS). You can:

•Apply online at irs.gov

•Apply by mail with IRS Form SS-4. To obtain this

form, download or order it from irs.gov or call

800-829-3676.

Enter the Principal Business Activity Code that applies to Florida business activities. If the Principal Business Activity Code is unknown, see the IRS “Codes for

Principal Business Activity” section of federal Form 1065.

General Information

Both the income and the apportionment factors are

considered to “flow through” to the members of a

partnership or joint venture.

Use parts I and II of the Florida Partnership Information Return to determine each partner’s share of the Florida partnership income adjustment.