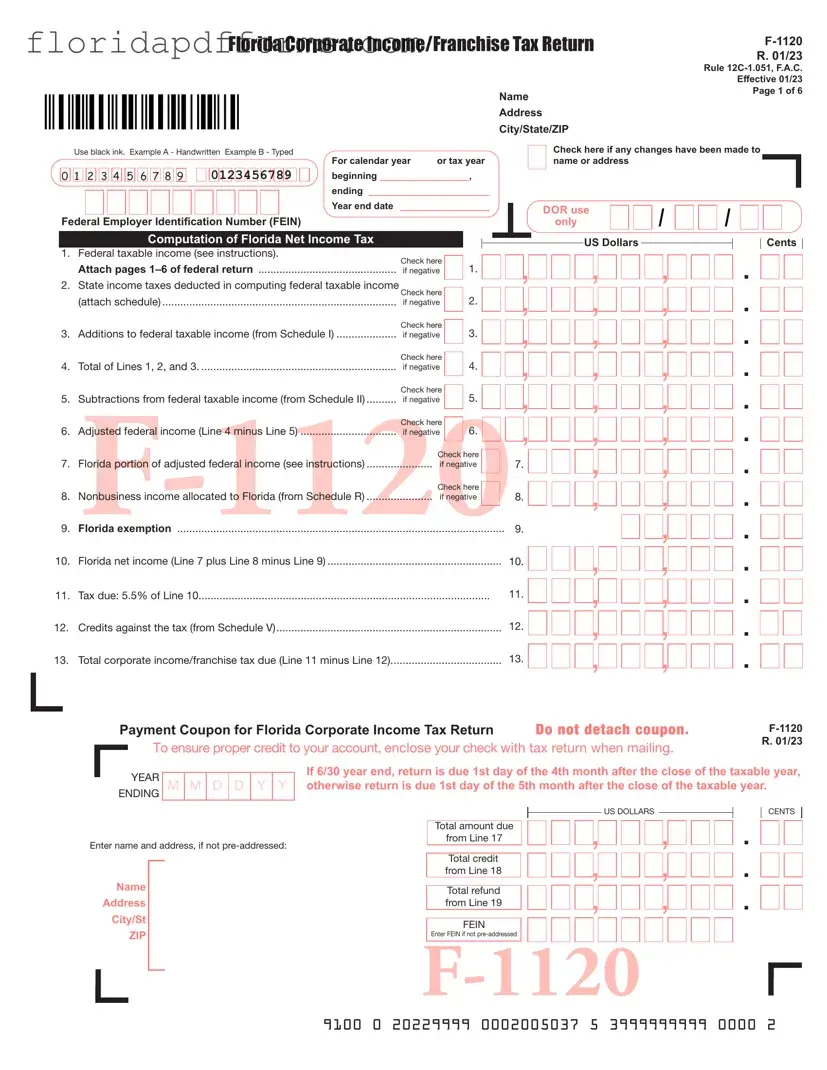

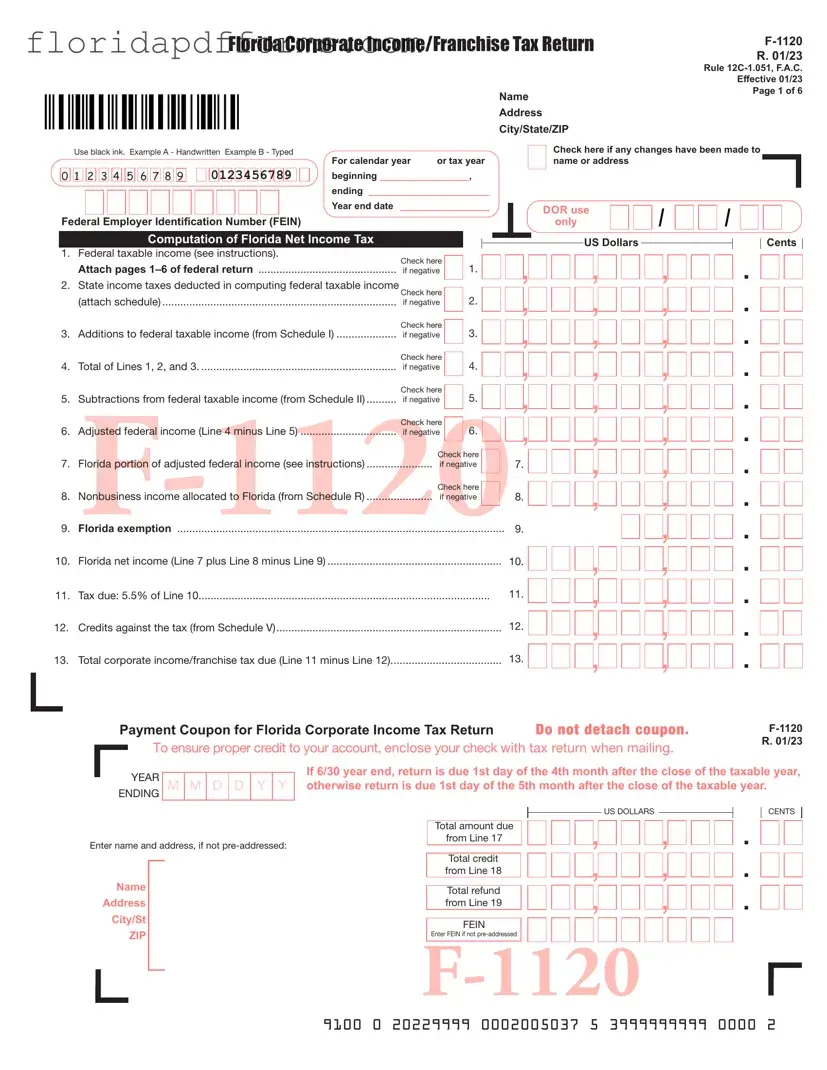

The Florida F-1120 form, which is used for corporate income and franchise tax returns, shares similarities with the federal Form 1120. Both forms require corporations to report their income, deductions, and tax liabilities. They follow a similar structure, asking for information such as gross income, deductions, and tax credits. Just like the F-1120, the federal Form 1120 also requires a declaration under penalties of perjury, emphasizing the importance of accuracy in reporting. The federal form serves as the baseline for corporate taxation, while the Florida form adjusts for state-specific regulations and tax rates.

Another document that resembles the Florida F-1120 is the California Form 100. Like the F-1120, this form is used for corporate income tax reporting at the state level. Both forms require corporations to calculate their net income and apply the appropriate tax rates. They also include sections for reporting various credits and deductions specific to each state. The California Form 100, however, incorporates unique state tax laws and rates, reflecting the differences in corporate taxation between Florida and California.

The New York State Form CT-3 is another document similar to the Florida F-1120. This form is used by corporations operating in New York to report their income and calculate their franchise tax. Both forms require detailed financial information, including income, deductions, and tax credits. They also necessitate the inclusion of a federal return copy as part of the submission. While the CT-3 follows a structure similar to the F-1120, it incorporates New York-specific tax regulations and credits, highlighting the variations in state tax systems.

The Texas Franchise Tax Report is comparable to the Florida F-1120 in that it serves as a state-level tax return for corporations. Both forms require businesses to report their revenue and calculate their tax obligations based on state laws. The Texas report includes sections for deductions and credits, similar to those found in the F-1120. However, the Texas Franchise Tax Report operates under a different tax structure, as Texas does not impose a traditional corporate income tax but rather a franchise tax based on revenue.

The Massachusetts Form 355 is another document that shares similarities with the Florida F-1120. This form is used by corporations in Massachusetts to report their income and calculate their corporate excise tax. Both forms require detailed financial reporting and include sections for various deductions and credits. While the overall purpose is similar, the Massachusetts Form 355 incorporates specific state tax regulations and rates, reflecting the unique tax environment of Massachusetts.

The Illinois Form 1120 is also akin to the Florida F-1120, as both are used for corporate income tax reporting. Each form requires corporations to provide information about their income, deductions, and tax credits. The Illinois form includes specific sections for adjustments to federal taxable income, mirroring the adjustments required in the Florida F-1120. However, the Illinois tax system has its own rules and rates, which differ from those in Florida.

Another similar document is the Pennsylvania Corporate Tax Report (RCT-101). Like the Florida F-1120, this report is used for corporate income tax purposes at the state level. Both forms require corporations to detail their financial activities, including income and deductions. The Pennsylvania form also includes sections for tax credits, similar to those on the F-1120. However, Pennsylvania has its own tax structure and rates, which must be navigated by corporations operating in that state.

The Ohio Commercial Activity Tax (CAT) return is comparable to the Florida F-1120 in that it serves as a state-level tax return for businesses. Both forms require the reporting of revenue, although the CAT focuses on gross receipts rather than net income. Each form includes sections for claiming deductions and credits, but the Ohio CAT operates under a unique tax framework that is distinct from Florida's corporate income tax system.

The Georgia Corporate Income Tax Return (Form 600) also resembles the Florida F-1120. This form is used by corporations in Georgia to report their income and calculate their state tax obligations. Both forms require detailed financial disclosures, including income and deductions. The Georgia form includes sections for tax credits similar to those on the Florida form. However, Georgia's tax rates and regulations differ from those in Florida, necessitating careful compliance with state-specific requirements.

Lastly, the Michigan Corporate Income Tax (CIT) return is another document similar to the Florida F-1120. This return is used by corporations operating in Michigan to report their income and calculate their tax liability. Both forms require a comprehensive breakdown of income and deductions, along with sections for credits. The Michigan CIT operates under a different tax structure, focusing on gross receipts rather than traditional income, which sets it apart from Florida's corporate income tax system.

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.