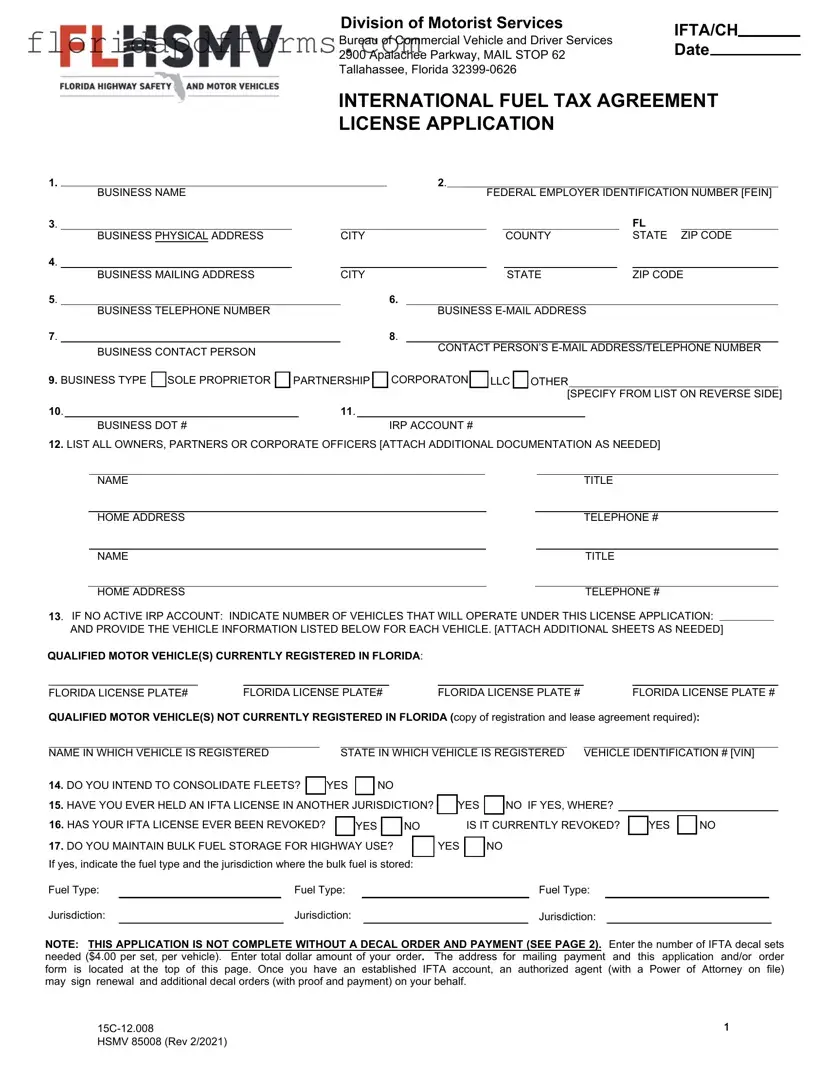

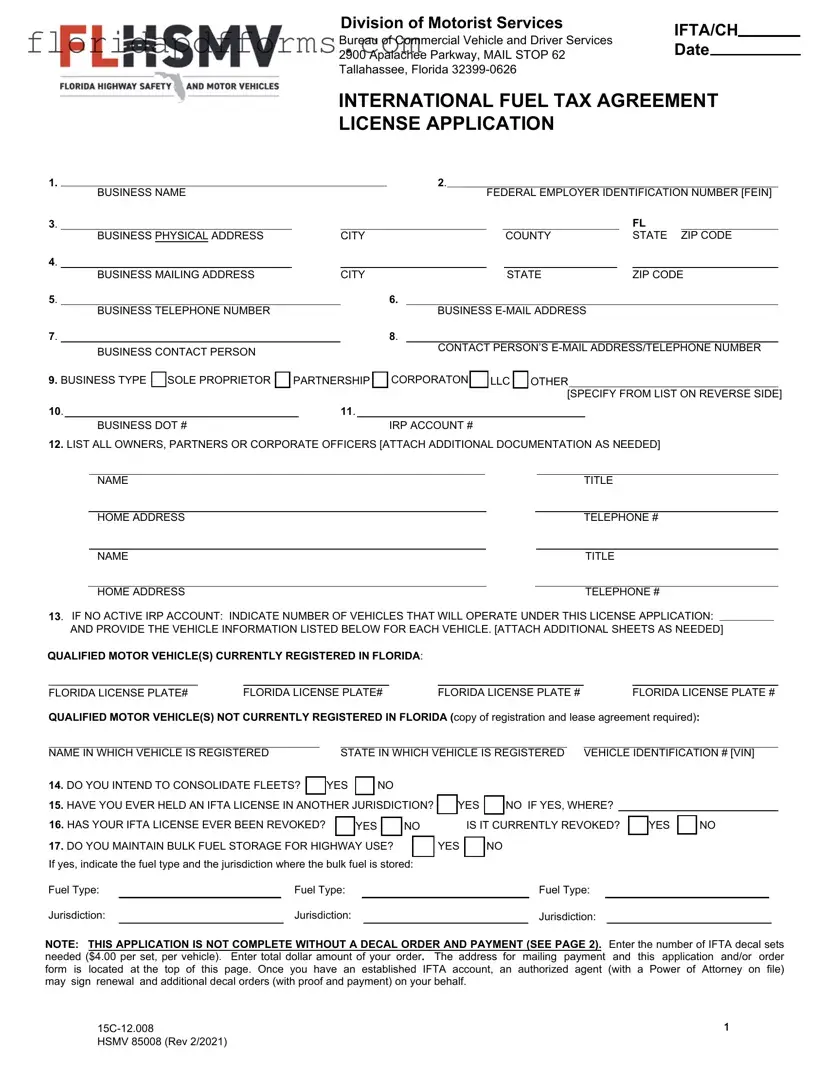

APPLICATION INSTRUCTIONS

1.BUSINESS NAME – Print the name of the motor carrier business making application. If the name is other than an individual's name, attach a copy of the corporation papers or fictitious trade name papers filed with the Florida Secretary of State.

2.FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) – Print your business’s FEIN. Your FEIN should always be referenced when inquiring

on your account.

The following contact information is needed for the business that is making application for an IFTA license. If your business will be using authorized agents to manage your IFTA correspondence and shipment of credentials, you must submit a completed, signed, and notarized Power of Attorney (POA) form (HSMV 96440). Once this POA form is on file, any one of your authorized agents may submit a request to update the shipping address you would like used for your IFTA routine correspondence and credentials.

3.BUSINESS PHYSICAL ADDRESS – Enter the Florida physical location (address, city & zip) of your motor carrier business or office. Post office boxes or rented mail boxes are NOT acceptable.

4.BUSINESS MAILING ADDRESS – Enter the address, city, state & zip used by the business. This address cannot be the address of a service provider or permitting company.

5.BUSINESS TELEPHONE NUMBER – Enter the business telephone number, including area code.

6.BUSINESS E-MAIL ADDRESS – Enter the business e-mail address.

7.CONTACT PERSON – Enter name of internal company person to contact about this account (if not licensee/company officer, attach letter designating this company employee).

8.CONTACT PERSON’S E-MAIL ADDRESS – Enter the contact person’s e-mail address and telephone number.

9.TYPE OF BUSINESS OWNERSHIP – Specify the type of business you own. Other options are Limited Company, LTD Liability LTD Partnership, Limited Liability Partnership, Company Limited, Limited Partnership.

10.U.S. DOT NUMBER – Enter the U.S. DOT number of the business.

11.INTERNATIONAL REGISTRATION PLAN (IRP) ACCOUNT NUMBER – Enter your Florida IRP account number. If you do not have a Florida IRP account, you must provide VEHICLE INFORMATION for each vehicle in your fleet See #13, below.

12.OWNER, PARTNERS OR CORPORATE OFFICER’S NAME(S) – Print the name, home address, city, state & zip, title, and telephone number of every company officer. Attach additional pages to the application, as necessary.

13.VEHICLE INFORMATION – If you do not have a Florida IRP account, indicate the total number of qualified vehicles that will operate under this license application. Provide the license plate number of those vehicles that are registered in Florida and, for those vehicles registered out of state, the name, state of registration, and VIN (with attached proof). Attach additional pages to the application, as necessary.

14.Use a check mark to indicate whether you intend to consolidate ALL of your vehicles in Florida.

15.Use a check mark to indicate whether you have ever held an IFTA license in another jurisdiction and, if YES, indicate jurisdiction(s).

16.Use a check mark to indicate whether your IFTA license has ever been revoked.

17.Use a check mark to indicate whether you maintain bulk fuel tanks, and, if YES, indicate type of fuel stored and the jurisdiction where the bulk fuel tanks are located.

FOR OFFICIAL USE ONLY (WALK IN COUNTER)

DECAL #(S) |

|

PRESENTED TO (PRINT NAME): |

|

SIGNATURE OF RECIPIENT: |

DATE: |