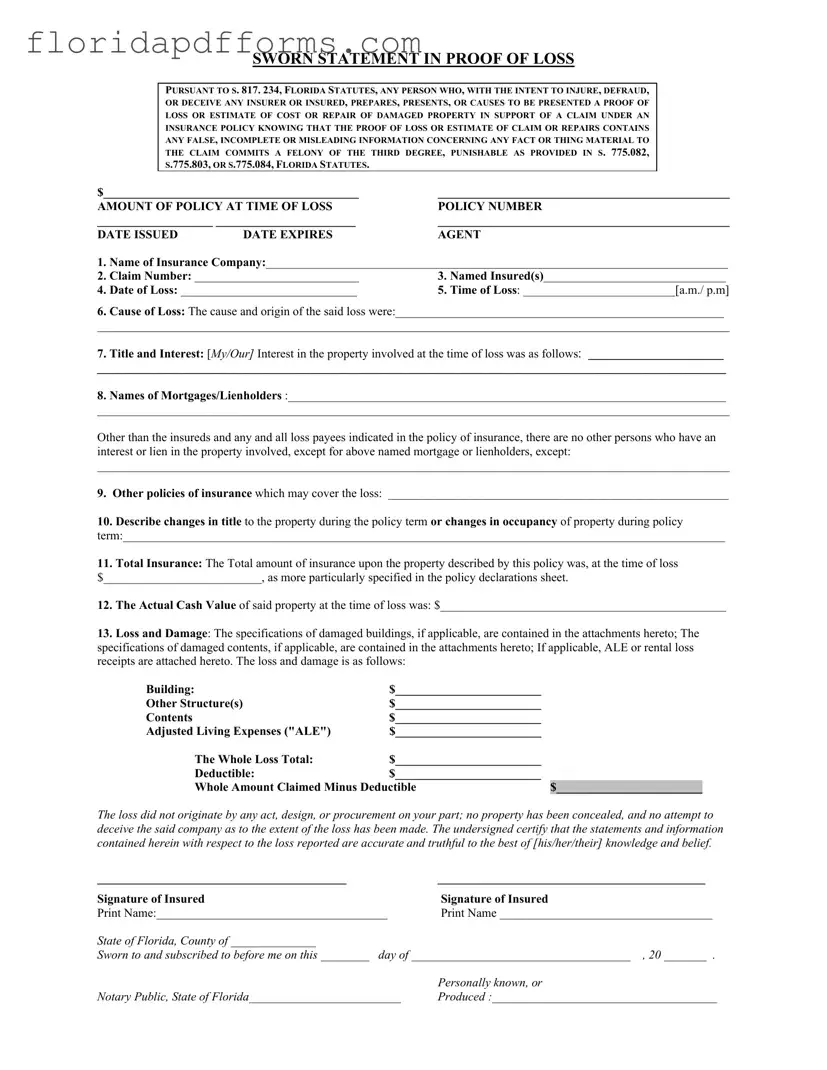

SWORN STATEMENT IN PROOF OF LOSS

PURSUANT TO S. 817. 234, FLORIDA STATUTES, ANY PERSON WHO, WITH THE INTENT TO INJURE, DEFRAUD, OR DECEIVE ANY INSURER OR INSURED, PREPARES, PRESENTS, OR CAUSES TO BE PRESENTED A PROOF OF LOSS OR ESTIMATE OF COST OR REPAIR OF DAMAGED PROPERTY IN SUPPORT OF A CLAIM UNDER AN INSURANCE POLICY KNOWING THAT THE PROOF OF LOSS OR ESTIMATE OF CLAIM OR REPAIRS CONTAINS ANY FALSE, INCOMPLETE OR MISLEADING INFORMATION CONCERNING ANY FACT OR THING MATERIAL TO THE CLAIM COMMITS A FELONY OF THE THIRD DEGREE, PUNISHABLE AS PROVIDED IN S. 775.082, S.775.803, OR S.775.084, FLORIDA STATUTES.

$__________________________________________ |

________________________________________________ |

AMOUNT OF POLICY AT TIME OF LOSS |

POLICY NUMBER |

___________________ _______________________ |

________________________________________________ |

DATE ISSUED |

DATE EXPIRES |

AGENT |

1.Name of Insurance Company:____________________________________________________________________________

2. |

Claim Number: ___________________________ |

3. |

Named Insured(s)______________________________ |

4. |

Date of Loss: _____________________________ |

5. |

Time of Loss: _________________________[a.m./ p.m] |

6.Cause of Loss: The cause and origin of the said loss were:______________________________________________________

________________________________________________________________________________________________________

7.Title and Interest: [My/Our] Interest in the property involved at the time of loss was as follows: ____________________

_____________________________________________________________________________________________

8.Names of Mortgages/Lienholders :________________________________________________________________________

________________________________________________________________________________________________________

Other than the insureds and any and all loss payees indicated in the policy of insurance, there are no other persons who have an interest or lien in the property involved, except for above named mortgage or lienholders, except:

________________________________________________________________________________________________________

9.Other policies of insurance which may cover the loss: ________________________________________________________

10.Describe changes in title to the property during the policy term or changes in occupancy of property during policy

term:___________________________________________________________________________________________________

11.Total Insurance: The Total amount of insurance upon the property described by this policy was, at the time of loss $__________________________, as more particularly specified in the policy declarations sheet.

12.The Actual Cash Value of said property at the time of loss was: $_______________________________________________

13.Loss and Damage: The specifications of damaged buildings, if applicable, are contained in the attachments hereto; The specifications of damaged contents, if applicable, are contained in the attachments hereto; If applicable, ALE or rental loss receipts are attached hereto. The loss and damage is as follows:

Building: |

$________________________ |

|

Other Structure(s) |

$________________________ |

|

Contents |

$________________________ |

|

Adjusted Living Expenses ("ALE") |

$________________________ |

|

The Whole Loss Total: |

$________________________ |

|

Deductible: |

$________________________ |

|

Whole Amount Claimed Minus Deductible |

$________________________ |

The loss did not originate by any act, design, or procurement on your part; no property has been concealed, and no attempt to deceive the said company as to the extent of the loss has been made. The undersigned certify that the statements and information contained herein with respect to the loss reported are accurate and truthful to the best of [his/her/their] knowledge and belief.

_________________________________________ |

____________________________________________ |

Signature of Insured |

Signature of Insured |

Print Name:______________________________________ |

Print Name ___________________________________ |

State of Florida, County of ______________

Sworn to and subscribed to before me on this ________ day of ____________________________________ , 20 _______ .