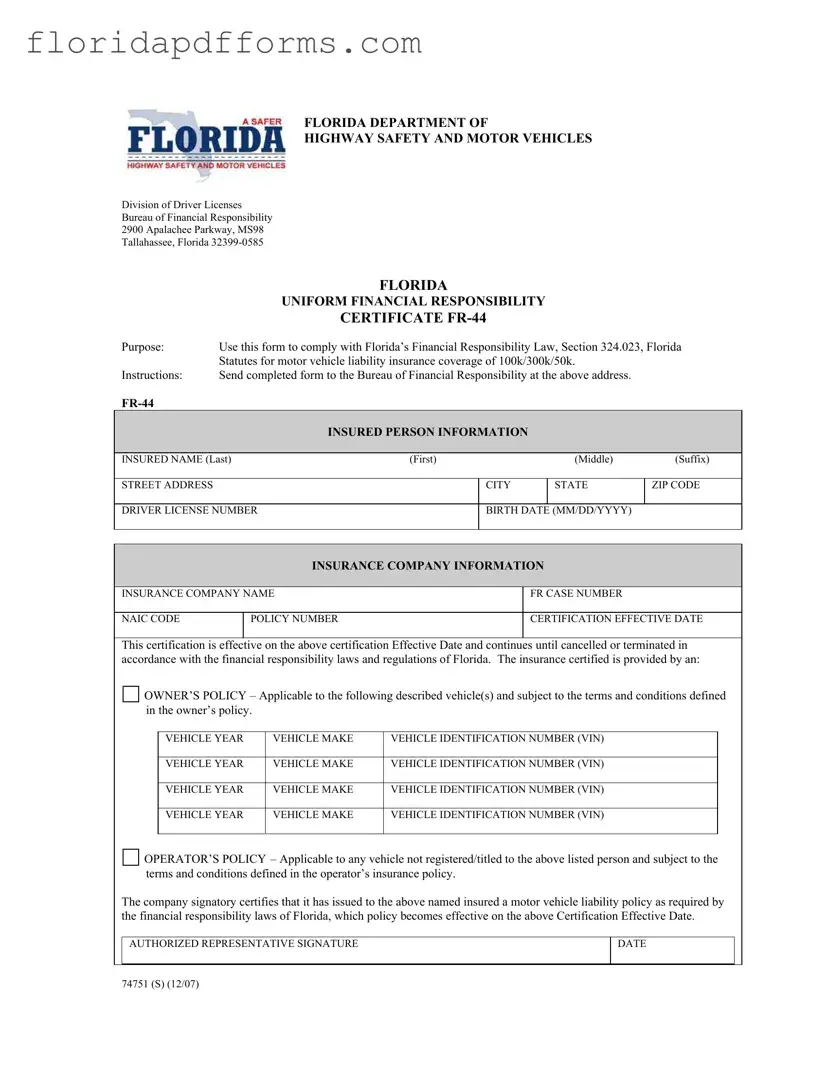

The FR-44 form in Florida serves as a financial responsibility certificate, primarily for those who have been convicted of certain driving offenses. It is comparable to the SR-22 form, which is often required for high-risk drivers. Like the FR-44, the SR-22 certifies that a driver has the minimum required liability insurance. Both documents are filed with the state to demonstrate compliance with insurance requirements, but the FR-44 mandates higher coverage limits, specifically $100,000 for bodily injury per person, $300,000 for total bodily injury per accident, and $50,000 for property damage.

Another similar document is the Proof of Insurance card. This card serves as immediate evidence that a driver has the necessary insurance coverage while on the road. While the FR-44 is a formal filing with the state, the Proof of Insurance card is typically presented during traffic stops or accidents. Both documents assure that the driver meets the financial responsibility laws, but the FR-44 is more comprehensive and formal in its requirements.

The Certificate of Insurance is another document that shares similarities with the FR-44. This certificate is often issued by an insurance company to confirm that a policy is active and meets certain coverage requirements. While the FR-44 is specifically tailored for Florida's financial responsibility laws, the Certificate of Insurance can be used in various contexts, such as verifying coverage for commercial vehicles or events. Both documents serve to confirm that a driver is insured, but the FR-44 has specific legal implications tied to driving offenses.

The Financial Responsibility Certificate (FR-19) also bears resemblance to the FR-44. This document is used to demonstrate financial responsibility following a traffic accident or violation. Similar to the FR-44, the FR-19 is a requirement in some states for drivers who have had their licenses suspended. Both forms are essential for reinstating driving privileges but differ in their application and the circumstances that necessitate their filing.

The Liability Insurance Declaration Page is another document that can be compared to the FR-44. This page outlines the details of an insurance policy, including coverage limits and effective dates. While the FR-44 serves as a formal notification to the state regarding compliance with financial responsibility laws, the Declaration Page provides a summary of the insurance coverage itself. Both documents are crucial for confirming that a driver meets the necessary insurance requirements, but they serve different purposes in the insurance process.

The Motor Vehicle Liability Insurance Policy is a foundational document that underpins the FR-44. This policy outlines the terms and conditions of coverage for the insured driver. While the FR-44 is a certification of compliance with state laws, the liability insurance policy provides the specifics of coverage. Both documents are interrelated, as the FR-44 depends on the existence of a valid insurance policy to be effective.

The State Financial Responsibility Form is another document similar to the FR-44. This form is used in various states to prove that a driver has the required insurance coverage. While the FR-44 is specific to Florida and its unique requirements, other states have their own versions that serve the same purpose. Both forms are essential for demonstrating compliance with state financial responsibility laws.

The Non-Owner Car Insurance Policy is another relevant document. This policy provides liability coverage for individuals who drive vehicles they do not own. While the FR-44 applies to those who own vehicles and have specific insurance requirements, the Non-Owner policy serves a different demographic. Both documents ensure that drivers are covered in case of an accident, but they cater to different situations regarding vehicle ownership.

Lastly, the Vehicle Registration Document can be considered in relation to the FR-44. This document is essential for legally operating a vehicle on public roads. While the FR-44 focuses on insurance compliance, the Vehicle Registration Document confirms that a vehicle is registered with the state. Both documents are vital for legal driving but address different aspects of vehicle operation.