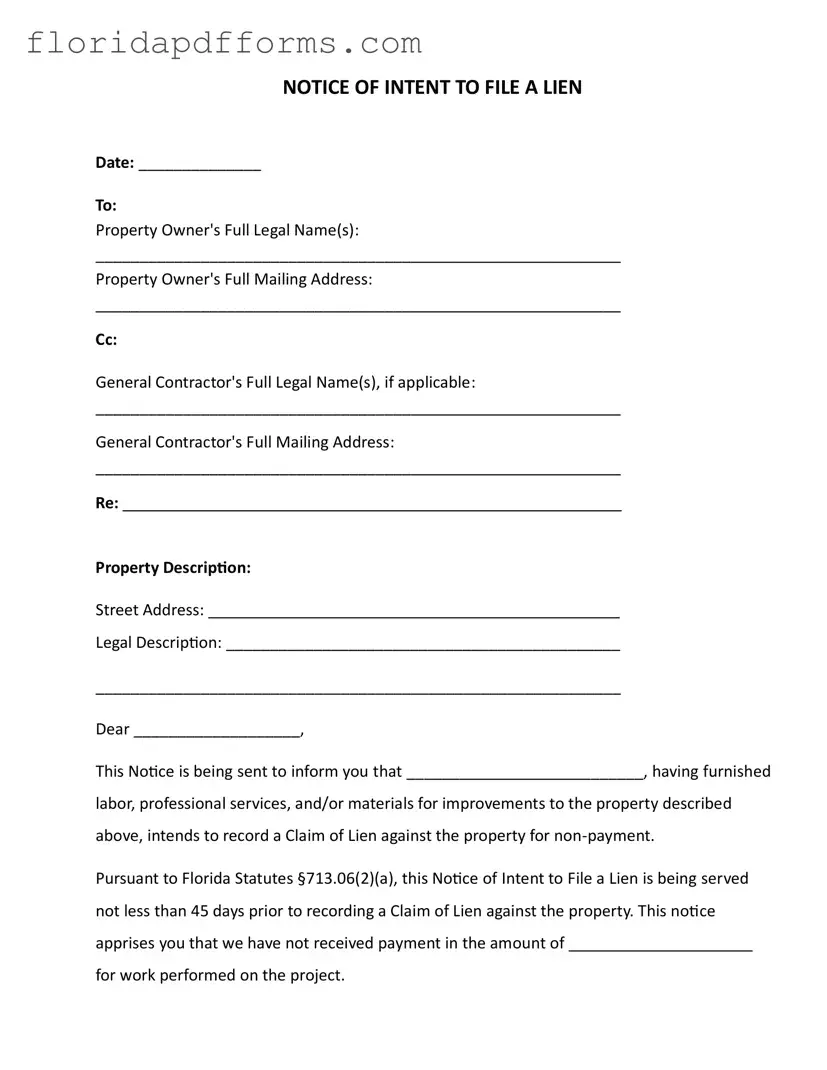

Fill in Your Intent To Lien Florida Form

The Intent To Lien Florida form serves as a formal notice indicating that a contractor or service provider intends to file a lien against a property due to non-payment for services rendered. This document is crucial for property owners, as it outlines the potential consequences of failing to address outstanding payments. Understanding this form can help property owners take timely action to avoid complications, such as foreclosure proceedings.

If you need to fill out the form, please click the button below.

Modify Intent To Lien Florida Now

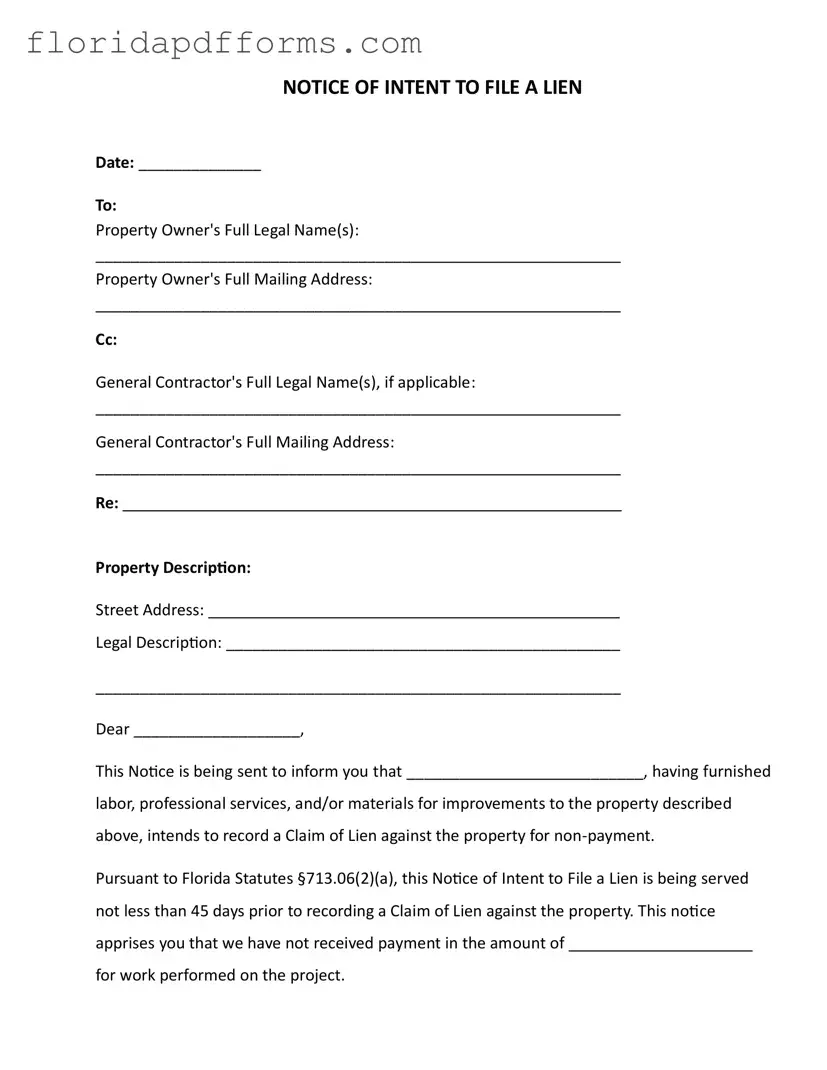

Fill in Your Intent To Lien Florida Form

Modify Intent To Lien Florida Now

Modify Intent To Lien Florida Now

or

⇓ Intent To Lien Florida File

Don’t stop halfway through your form

Finish your Intent To Lien Florida online with quick edits and instant download.