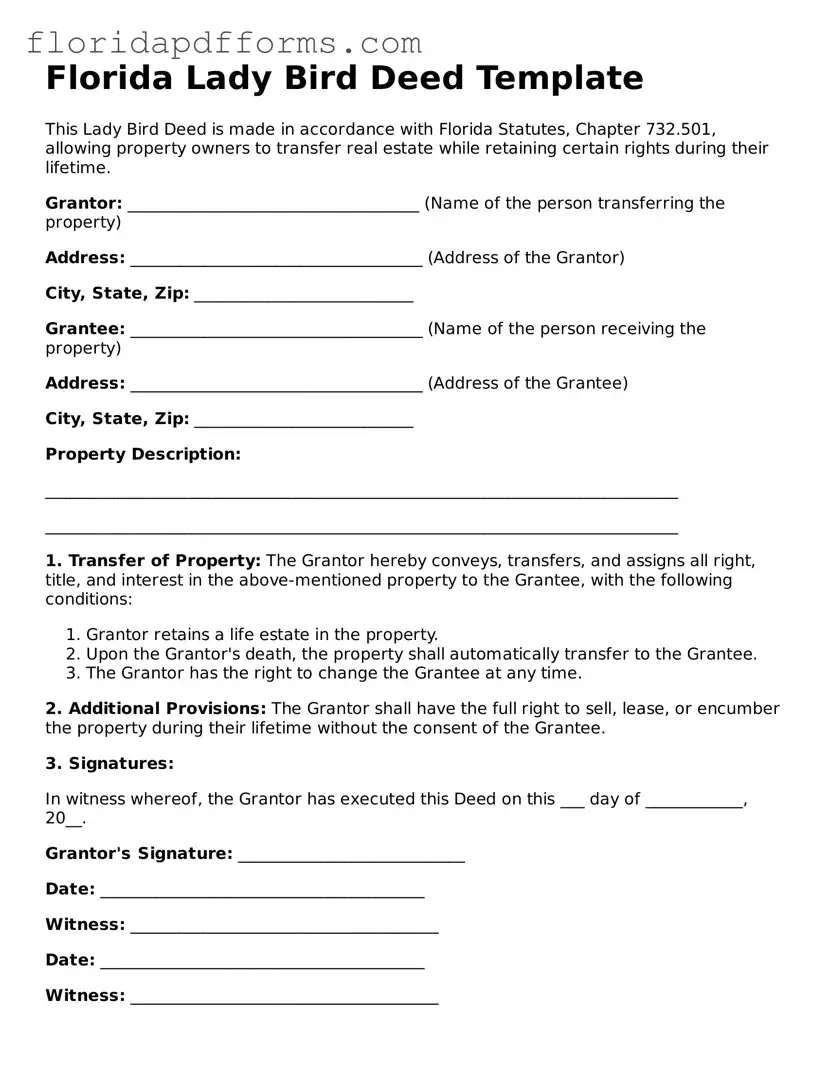

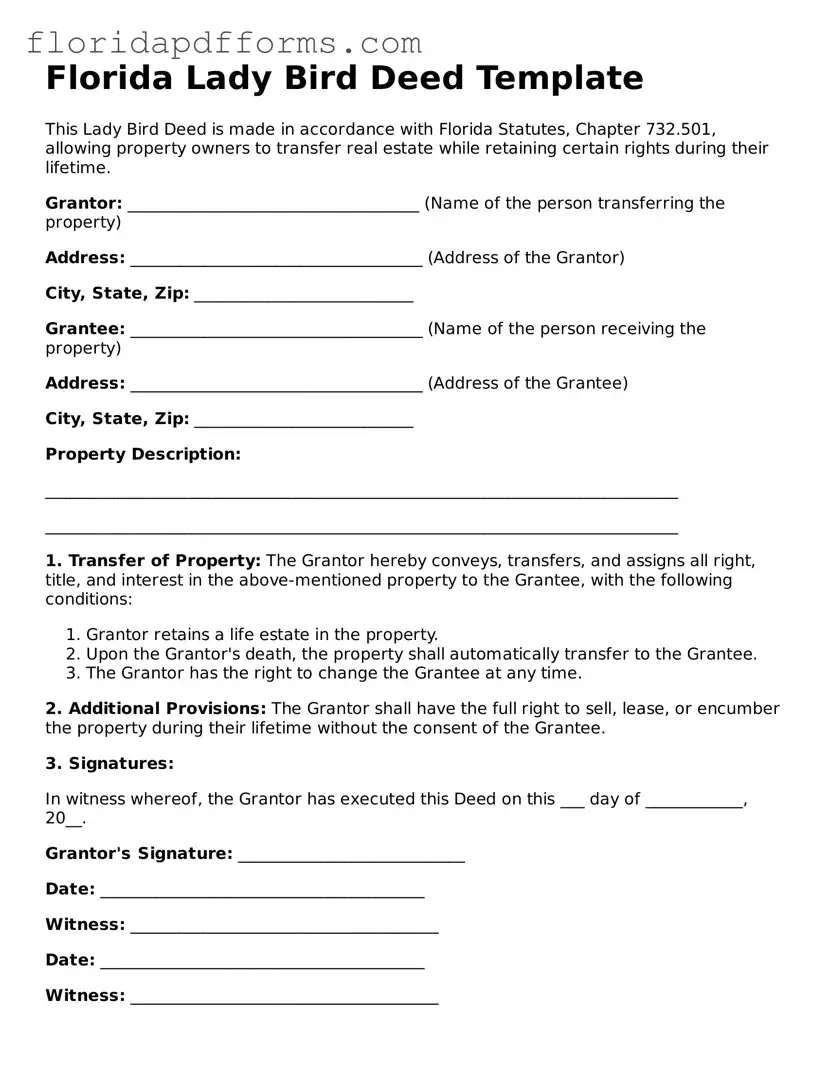

Official Lady Bird Deed Template for Florida

The Florida Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control over the property during their lifetime. This type of deed offers unique benefits, such as avoiding probate and providing flexibility in property management. Understanding the intricacies of this form is essential for effective estate planning.

To get started on filling out the Florida Lady Bird Deed form, click the button below.

Modify Lady Bird Deed Now

Official Lady Bird Deed Template for Florida

Modify Lady Bird Deed Now

Modify Lady Bird Deed Now

or

⇓ Lady Bird Deed File

Don’t stop halfway through your form

Finish your Lady Bird Deed online with quick edits and instant download.