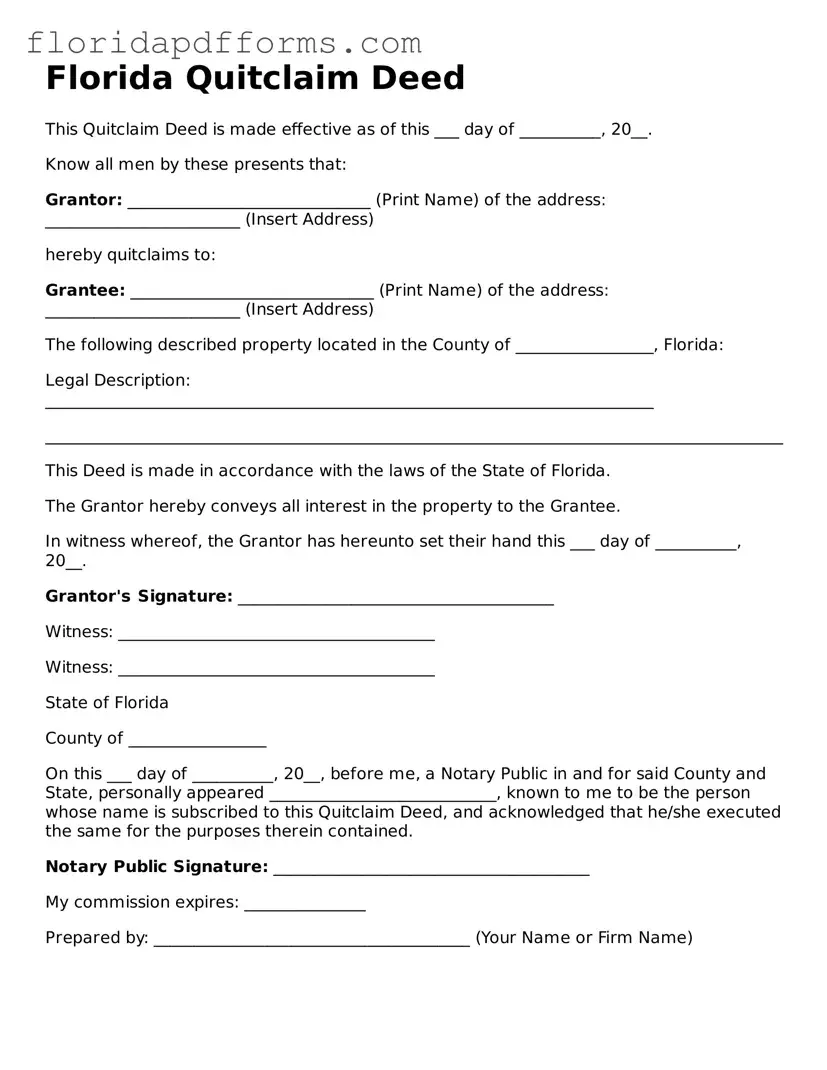

Official Quitclaim Deed Template for Florida

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. This form is often used in situations like transferring property between family members or clearing up title issues. If you're ready to complete your transfer, click the button below to fill out the form.

Modify Quitclaim Deed Now

Official Quitclaim Deed Template for Florida

Modify Quitclaim Deed Now

Modify Quitclaim Deed Now

or

⇓ Quitclaim Deed File

Don’t stop halfway through your form

Finish your Quitclaim Deed online with quick edits and instant download.