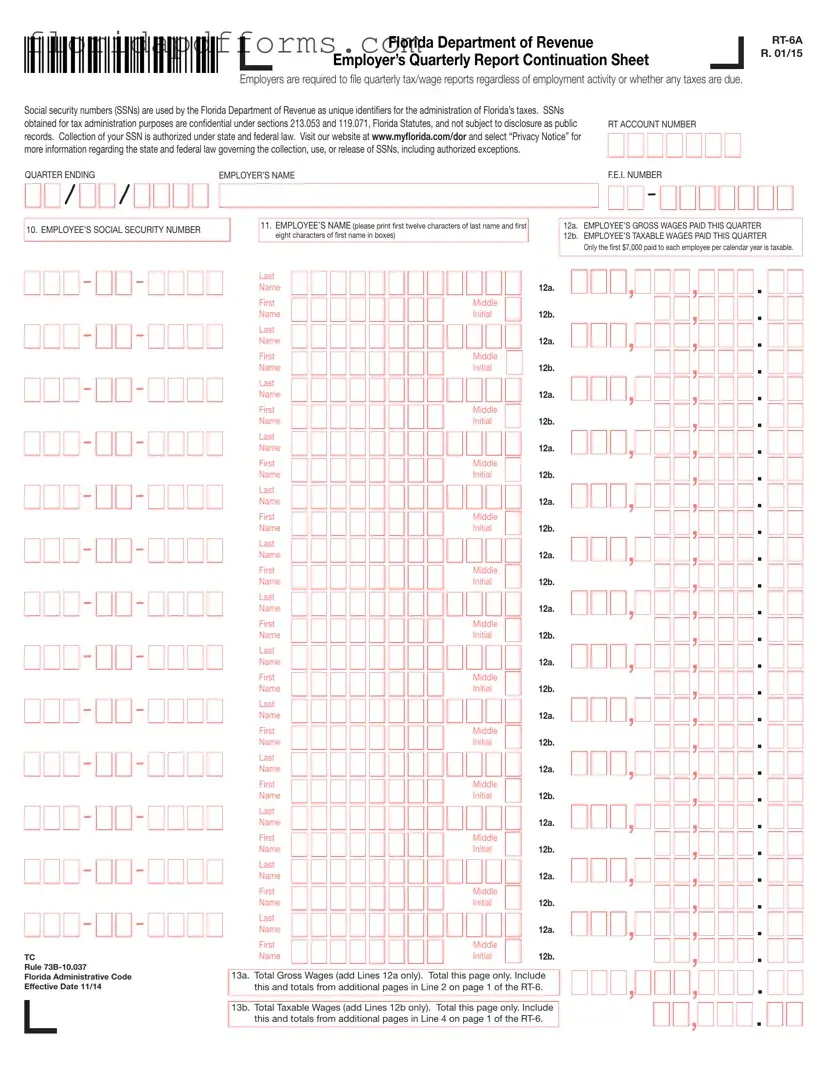

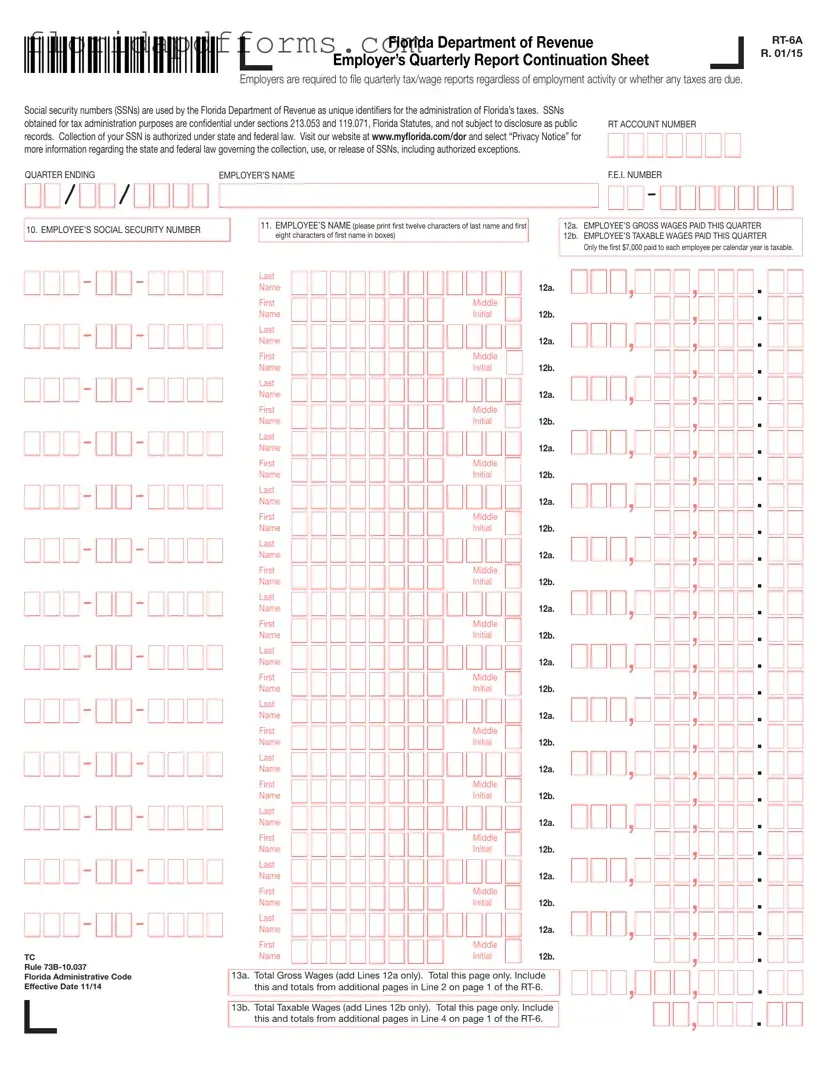

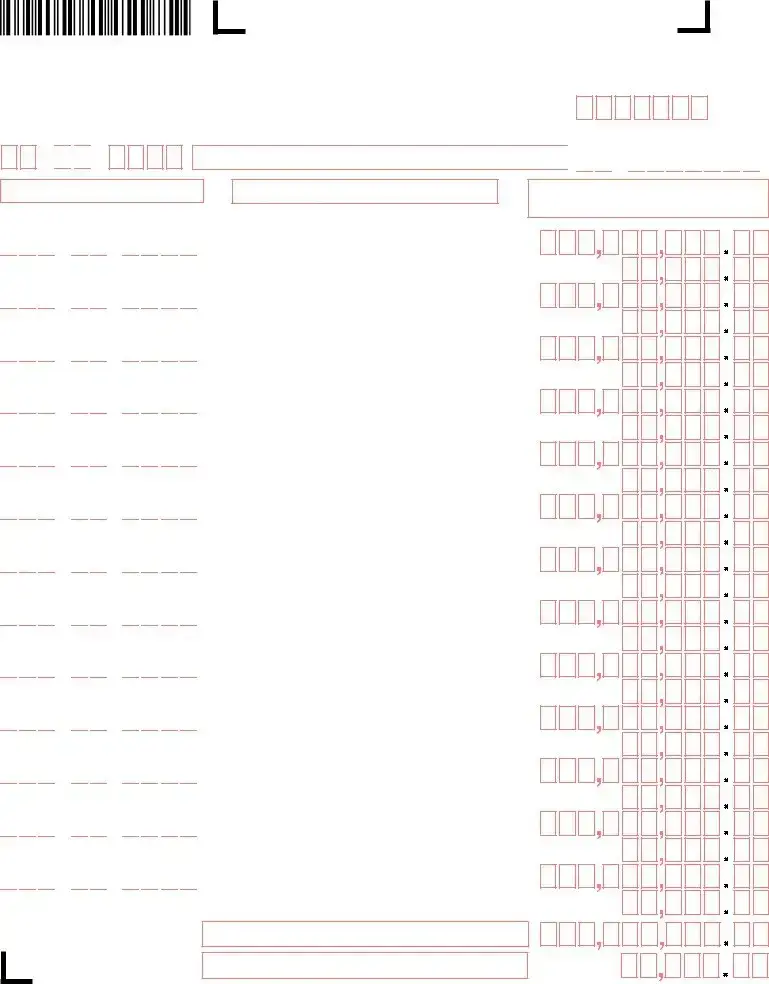

Fill in Your Rt 6A Florida Form

The RT-6A Florida form serves as the Employer’s Quarterly Report Continuation Sheet, a crucial document for employers in Florida. This form must be submitted quarterly, regardless of whether there is any employment activity or taxes owed. It ensures that the Florida Department of Revenue can effectively manage tax obligations while safeguarding the confidentiality of employees' social security numbers.

To fulfill your reporting requirements, please complete the form by clicking the button below.

Modify Rt 6A Florida Now

Fill in Your Rt 6A Florida Form

Modify Rt 6A Florida Now

Modify Rt 6A Florida Now

or

⇓ Rt 6A Florida File

Don’t stop halfway through your form

Finish your Rt 6A Florida online with quick edits and instant download.

/

/

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-