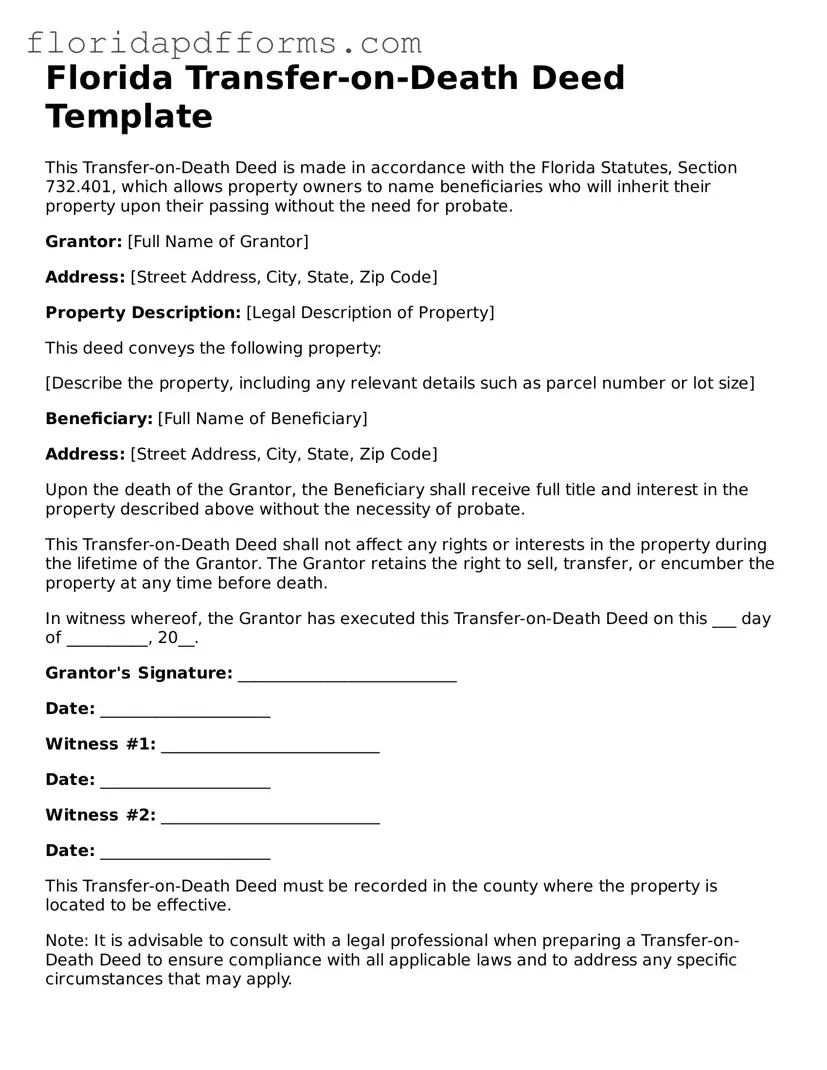

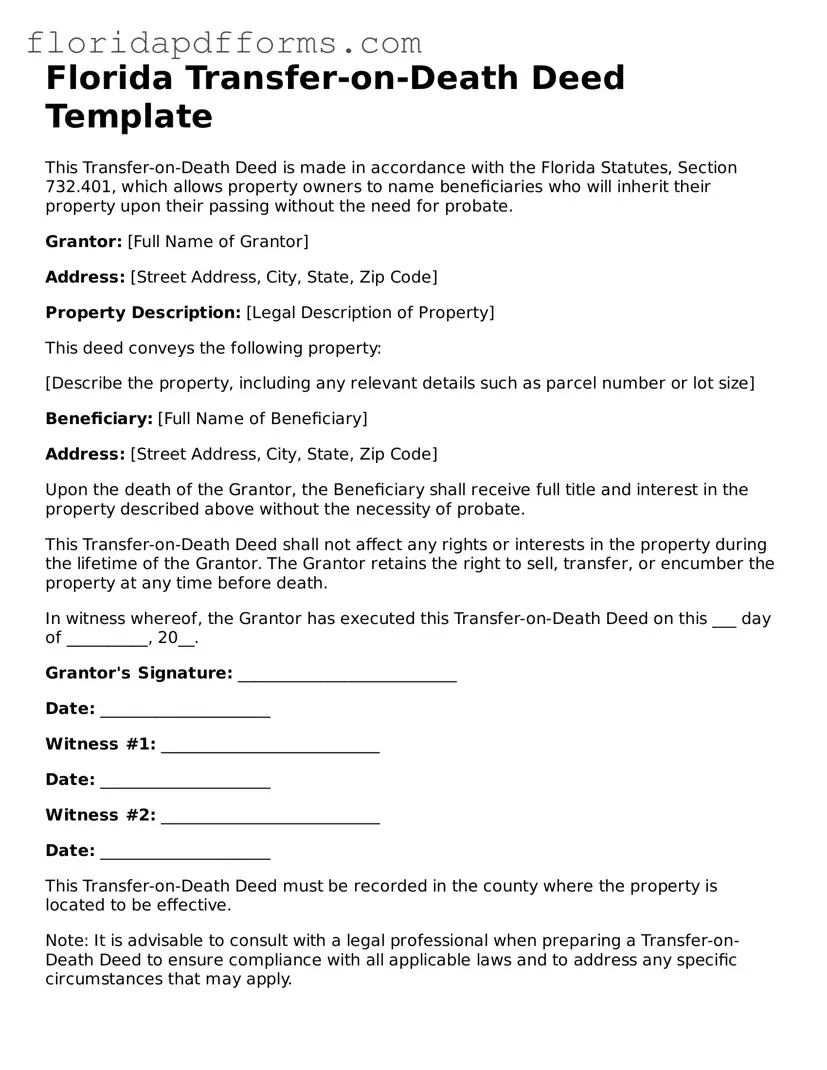

Official Transfer-on-Death Deed Template for Florida

The Florida Transfer-on-Death Deed form is a legal document that allows property owners to designate beneficiaries who will receive their property upon their death, bypassing the lengthy probate process. This straightforward tool can simplify estate planning and provide peace of mind for both property owners and their loved ones. Ready to take the next step? Fill out the form by clicking the button below.

Modify Transfer-on-Death Deed Now

Official Transfer-on-Death Deed Template for Florida

Modify Transfer-on-Death Deed Now

Modify Transfer-on-Death Deed Now

or

⇓ Transfer-on-Death Deed File

Don’t stop halfway through your form

Finish your Transfer-on-Death Deed online with quick edits and instant download.